Cameron County Luxury Residential Properties Experience High Reappraisals In 2025

O'Connor discusses the high reappraisals for Cameron County luxury residential properties in 2025.

HARLINGEN, TX, UNITED STATES, May 14, 2025 /EINPresswire.com/ -- Cameron Appraisal District has released proposed noticed values for property tax assessments in 2025. During the 2025 property tax reassessment in Cameron County, approximately 27% of homes were overvalued and 73% of homes were assessed at or below market value. Although the percentage of homes valued above market has dropped compared to 2024 (54%), there are still concerns for increased assessment values for the typical homeowner. The average home saw a minimal value increase of 3.1%, with luxury homes experiencing the greatest increase. Commercial properties experienced a greater rise of 4.6%.

Cameron County Home Tax Assessments Increase by 3.1%

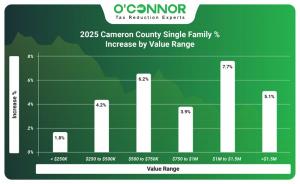

An analysis of property tax assessments by value range in Cameron County shows no clear correlation; however, luxury or high-value homes experienced the greatest increases. Homes valued at over $1.5 million saw an increase of 5.1% and homes valued between $500k to $750K increased by 6.2%. The highest increase was seen in luxury homes valued between $1 million to $1.5 million with 7.7% and the 2025 notice market value was $393 million.

In Cameron County, property values per square foot generally increased with home size, especially larger homes. A positive trend shows that the larger the home’s square footage, the greater the increase in assessment. Homes measuring between 6,000 and 7,999 square feet saw the greatest rise of 8.9%, growing from $200 million to $217 million. In contrast, homes under 2,000 square feet saw the lowest value increase of 2.8%, growing minimally from $13.7 billion to $14.1 billion.

According to reports from the Cameron Appraisal District, several homes according to year built faced slight increases in assessment values for 2025, except for newer homes. Homes built in 2021 or later saw the greatest value growth by 28.9%, growing from $1.7 billion to $2.2 billion. Categories ranging from 1961 to 2020 saw minimal increases ranging from 0.7% to 1.6%. Homes built before 1960 was the only category to see no change and remained constant at $1.7 billion market value.

Despite Improvement in Market Value, Homeowners Are Still Impacted

In 2025, Cameron Appraisal District overvalued 27% of homes in the county based on a comparison between the 2025 reassessed property values and actual home sales prices from 2024. Meanwhile, 73% of homes were assessed below their market value. In 2024, 46% of homes were valued at or below market, while a high of 54% of houses were overvalued. Compared to the 2024 market value, fewer homes are being overvalued — a sign of progress. However, many homeowners are still burdened with high property tax bills due to inaccurate or unfair assessments.

High-Value Commercial Property in Cameron County Experienced the Highest Increases in 2025

An analysis of commercial property tax assessments in Cameron County by value range shows that high-value property experienced the greatest assessment increases. Properties valued between $1 million to $5 million increased by 7.9%, while properties valued at $500k or less also increased by 2.5%. The market value from 2024 to 2025 grew from $6.6 billion to $6.9 billion, recording a 4.6 assessment increase for the county.

For the 2025 tax year, the Cameron Appraisal District raised the market values across all categories of commercial properties particularly for 3 types. The largest increases were seen in warehouses with 10.2% and apartments with 10.7%. Land and office property increased by 4.3% and 3.3% respectively. The lowest growth was seen in hotel property with only 0.9%.

The Cameron Appraisal District increased 2025 commercial property assessments across all construction years, with no clear trend or correlation. Properties built in 2021 or later experienced the largest growth, with a 24.5% increase and a total 2025 market value of $190 million. Following behind is property built between 1961 to 1980 with 8.1%. The lowest growth was seen in commercial property built before 1960 with 2.3%, from $224 million to $229 million.

Sharp Contrast Between Appraised Property Values and Market Value Trends

The Cameron Appraisal District’s 2025 commercial property tax reassessment sharply contradicts a recent analysis by Wall Street firm Green Street Real Estate Advisors. While Green Street reports a 21% decline in commercial property values since their 2022 peak, the appraisal district claims those same values have risen by over 4.6% in the past year.

Apartment Buildings in 2025 Increased In Assessment Value by 10.7%

The graph displays massive growth for every category for the year an apartment was built and the percentage increase in property tax assessments in Cameron County for 2025. Apartments constructed in 2021 or later experienced the highest increase at 22.7%, from $62 million to $76 million. In contrast, those built with no construction date category saw only a 3.2% rise. Other notable increases was seen in apartments built between 1961 to 1980 with 16.7%.

Apartment owners in Cameron County saw a sharp rise in property taxes in 2025, with the Cameron Appraisal District increasing the overall taxable value of apartment buildings by 10.7%. The market value from 2024 to 2025 grew from $1 billion to $1.1 billion. There are two sub-types of apartments: apartment gardens and multifamily residences. Apartment gardens increased by 23.1% and multifamily residences increased by 10.5%.

Newer Office Building in Cameron County Increased in Value in 2025

According to the Cameron Appraisal District, property tax assessments for office buildings in 2025 have increased across all construction years, especially more modern offices. The smallest increase — 2.4% — applies to offices built between 1981 to 2000. The highest increase, 15.7%, belongs to office buildings constructed in 2021 or later. Office buildings with no year built date stayed constant with no change at $4.7 million.

Although there are two sub-types of office property in Cameron County, only one category increased while the other stayed the same with no change. Medical office buildings saw a 0% increase for 2025 and stayed the same at $224 million market value. Meanwhile general office buildings experienced an increase of 4.7%, rising from $543.3 million to $569 million.

Newer Retail Properties in Cameron County Experienced the Greatest Growth

Property tax assessments for retail buildings in Cameron County rose particularly for newer builds. Retail properties constructed before 1960 was the only category to witness a decline in assessment by 1.8%, falling from $127.8 million to $125.6 million. The greatest growth was seen in retail property built in 2021 or later with 18.6%, rising from $45.6 million to $54.1 million. Retail property with no specified construction date stayed the same at $326 thousand.

2025 Property tax assessments for retail property sub-types in Cameron County saw no or very minimal increases, including one category experiencing a decline. Retail stores saw the greatest increase of 5.3%. Neighborhood shopping centers saw a decline of 3.2%, falling in market value from $561.5 million to $543.7 million. Community shopping centers and regional shopping centers saw no change, remaining at $181 million and $42 million respectively.

Cameron Appraisal District Warehouse Tax Assessments Increased by 10.2%

All warehouse building owners in Cameron County saw property tax increases, with no clear trend. Warehouses built in 2021 or later faced the highest growth of 23.9%, while those constructed between 2001 and 2020 faced a slight rise of 5.7%. Other notable increases include warehouses built between 1981 to 2000 with 11.6% and warehouses built between 1961 to 1980 with 8.2%.

The Cameron Appraisal District determined the market values of three categories of warehouse properties, mini, regular warehouses, and office warehouses. Office warehouses increased the greatest out of the three by 11.9% and mini warehouses increased by 5.4%. Regular warehouses was the only sub-type to experience a decline of 7.4%, dropping from $2.7 million to $2.5 million. The total market value grew from $417 million in 2024 to $460 million in 2025.

The Cameron Appraisal District increased by 3.1%, while the Harlington Metro home prices have declined by 6.1% from January 2024 to January 2025.

Summary for Cameron Appraisal District 2025 Property Tax Revaluation

In 2025, property owners in Cameron County are experiencing significant increases in property tax assessments, especially for high-value residential and commercial properties. Residential property values have risen by 3.1%, and commercial values by 4.6%, based on factors like value range, square footage, and year built. Although some homeowners saw relief in the past year from previously inflated assessments, many are still facing unfairly high valuations, raising concerns for the average property owner.

Appeal Your Property Values Each and Every Year

Texas property owners – yes, even in Cameron County – your property tax bill isn’t set in stone.

Whether you own a cozy home or a bustling commercial space, you have the right to appeal an unfair valuation. Most property owners who protest yearly see tax savings, resulting in tax relief and increase cash flow. Why go at it alone? For over 50 years, O’Connor has been helping clients, using reliable strategies to cut down tax bills. Appealing your property taxes isn’t just possible — it’s worth it.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Texas, Illinois, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Distribution channels: Banking, Finance & Investment Industry, Building & Construction Industry, Business & Economy, Consumer Goods, Real Estate & Property Management

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release