A global data center conference chose DC as its host city for its annual event — about an hour away from the sector’s main geographic hub.

Data Center World brought in more than 4,000 attendees across a week of programming last month at the Walter E. Washington Convention Center in downtown DC. Panels and talks focused on workforce development, energy innovation and construction. Household names like “Shark Tank’s” Kevin O’Leary gave remarks, in addition to some local leaders from the data center capital of the world.

Data centers, which doubled in megawatt supply in North America between 2023 and 2024, have a particularly high concentration in one Northern Virginia county — Loudoun County. The region dubbed “Data Center Alley” already has 200 data centers and 117 to be built, per a white paper published by the Ashburn District Supervisor Mike Turner.

This surge presents many local issues, like demands on the energy grid. That makes Northern Virginia a key place to solve the problems, he said on a panel at the conference.

“If you can solve it in Loudoun County,” Turner said, “you can solve it anywhere.”

Given this demand’s growth in tandem with increased artificial intelligence use, as well as the energy required to power and cool these massive sites, panelists acknowledged concerns from consumers, alternative energy possibilities and the need for more work pipelines into the industry.

These conversations are taking place at the Commonwealth’s highest political levels. Virginia Gov. Glenn Youngkin vetoed a bill Friday that would require site assessments, including a review of environmental and noise impacts from data centers.

Keep scrolling to get more details and key takeaways from the Data Center World conference.

Data centers have a ‘PR problem’

There’s no question that data centers have a negative perception, as electricity costs go up for consumers and noise pollution disrupts people’s sleep.

“Shark Tank’s” O’Leary highlighted this narrative issue as much during a keynote about investing in data centers.

“This is a huge PR problem,” he said, adding: “My job for this industry is to communicate to everybody that we are really good guys. We’re coming to town and we’re bringing power.”

That power is stranded natural gas, one of his investment priorities. He additionally noted the intentionality of that language — to avoid framing infrastructure as needing gas or oil, but “power.”

Other speakers addressed this desire to reframe the narrative. Buddy Rizer, the executive director of Loudoun County Economic Development, is urging data center leaders to try to push their narratives more, he said on a panel.

“We are a major hub for Google, Microsoft, Meta,” Rizer said. “Those are good things. I think that for the longest time, we were reticent to tell our own story, because there’s always going to be a story told. If you’re not telling the story, then you surrender the narrative to somebody else.”

He cited benefits from data centers’ property tax revenue, like improvements to schools and roads in Loudoun County, as a detail to help push positive framing.

He also noticed that as more data centers were built, the more people took notice and started to show concerns about noise pollution and how the massive structures looked in communities. Before the pandemic, he saw people being “positive” about data centers, he said.

With these complaints, listening is key, Rizer said. He gets a lot of hate mail, but also makes an effort to return emails and calls, and attend public meetings to talk to people. That engagement has helped, he said.

“They felt like I’m not some nameless, baseless bureaucrat who’s just focused on tax revenue, right?” he said. “That I’m actually part of the community, that I’m listening, that I’m responding and always respectful, even if they’re not respectful to me.”

More energy options are needed to power data centers

O’Leary started investing in data centers years ago. His venture firm, O’Leary Ventures, is focusing on investing in stranded natural gas for at least the next five years, he said.

The term refers to gas resources not yet tapped for economic reasons. Simply put, the cost of development and production is too expensive when compared to the value of the gas in the marketplace.

Using stranded natural gas will change that story, he hopes.

Data centers consumed about 4.4% of total US electricity in 2023, per data the Department of Energy released at the end of 2024. That’s expected to increase to as much as 12% by 2028.

Much of the data center industry has an interest in nuclear energy. For example, Amazon Web Services signed several agreements to develop nuclear power projects, including one at Virginia’s Lake Anna.

Ashburn’s Turner said the industry is moving to nuclear power options, but not in Loudoun County at the moment. The amount of waste produced makes him hesitant about small modular reactors.

Instead, he wants to see a microgrid set up on land just south of Dulles airport, because there isn’t enough land in Data Center Alley to pull this off. It would be on a separate line from the commercial and residential grid structure, but that’ll take a lot of time, planning and coordination to pull off, he said.

“Nuclear is coming,” Turner said. “That is the wave of the future.”

Regardless of these issues, data center construction can’t slow down, said CIO Nancy Novak of Compass Datacenters, a multinational developer of data center infrastructure based in Texas. That would slow down innovation.

Every industry relies on data infrastructure, Novak said. It’s not an “if” more data centers are built, but a “how.” Identifying ways to sustainably build and power the structures is a major part of that.

The industry needs a proper workforce

There is a high demand for workers in the trades (such as electricians, welders and ironworkers) to build and maintain data centers. At the same time, according to Novak, the existing workforce is aging out of the industry, and there are too few young workers to step in.

“They’re going to be retiring in less than a decade, right?” Novak said, adding: “The skill level needs to be there. We’re in a crisis now.”

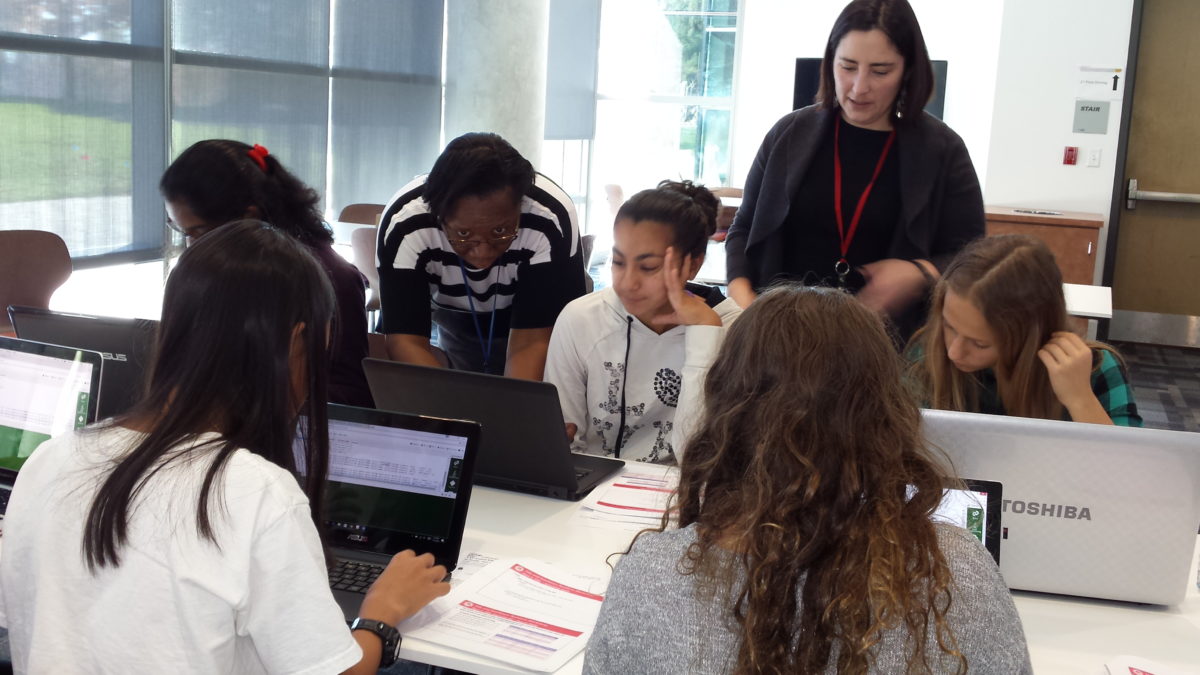

Workforce development is a major part of sustainable data center development, per consultant Mara Ervin, who spoke on a panel about collaboration in the industry. Several organizations are working on this in Loudoun County, including the Virginia Economic Development Partnership, local unions and community colleges. But she’s seen the work take place in silos.

“We’ve been doing it in pockets through these organizations,” Ervin said. “But we really haven’t come together.”

Since the federal government started implementing mass layoffs, Loudoun’s Rizer has seen former employees flood into community colleges to upskill. They aren’t just pursuing fields like technology and construction, but also fields like sales and marketing, which he finds crucial to the industry.

“There are these opportunities to reskill, reinvent, retrain yourself,” Rizer said, “and find something that is future-facing.”

Join our growing Slack community

Join 5,000 tech professionals and entrepreneurs in our community Slack today!

Donate to the Journalism Fund

Your support powers our independent journalism. Unlike most business-media outlets, we don’t have a paywall. Instead, we count on your personal and organizational contributions.

When global tech association CompTIA spun off its nonprofit arm, the TechGirlz curriculum went dark

A new $150M DC fund is betting on energy and agriculture, with a 'conscious capitalism' twist

This Week in Jobs: 25 out-of-this-world tech career opportunities