This is the second installment in a series of pieces in which members of the Womble Bond Dickinson Global Trade Advisors (GTA) team will review a number of current issues in international trade regulation, and discuss strategies for companies to stay aware of change in this dynamic area of law, and achieve their business goals, while avoiding regulatory noncompliance costs. We have modified somewhat our plan for inclusion of topics in this series from our original plan stated in our Introduction to this series, due to the recent dynamic nature particularly of import controls and charges in the U.S. over the past month.

In the first piece in the series, we reviewed the regulatory landscape of, and recent practice regarding, tariffs and other regulatorily mandated charges on imported goods including, in particular, antidumping duties (ADD) and countervailing duties (CVD).

Since returning to office in January, 2025, President Trump’s administration has used several statutory regimes as legal bases for increasing administrative charges on imported goods into the U.S. These statutory sources have included the following:

- The International Emergency Economic Powers Act (IEEPA) of 1977, which grants the President broad powers to regulate commerce after declaring a national emergency in response to any unusual and extraordinary threat to the U.S. that has a foreign source;

- The Trade Expansion Act of 1962, Section 232 (Section 232), which allows the President to adjust imports, including imposing increased tariffs, if the Department of Commerce (DOC) determines that imports from a particular country threaten national security;

- The Trade Act of 1974, Section 301 (Section 301), which gives the President broad authority to take action, including imposing increased tariffs, to enforce U.S. rights under trade agreements and to address unfair foreign trade practices; and

- Title VII of the Tariff Act of 1930, which provides the basis for investigations into unfair trading practices including dumping and subsidies, and lays out the requirements and authorities for antidumping and countervailing duty investigations and duty impositions.

These statutes, and regulations adopted pursuant to them, provide a variety of legal bases and defined procedures through which the President through executive action can raise duties on imports, payable by an importer to U.S. Customs and Border Protection (CBP) before imported goods can clear customs and enter the U.S. market.

In a recent client alert, issued by the broader International Trade and National Security team of which we are a part, we reviewed tariff increases adopted by the Trump administration in 2025 pursuant to several of these statutory authorities. The most attention in the media has been paid lately to the “reciprocal tariff” regime announced by the Trump administration on April 5, 2025. Tariff increases announced on particular countries as part of this regime, except for those announced on China, have been temporarily paused.

However, investigations pursuant to Section 232 and Section 301 authority are ongoing, and have received less attention and explanation in the media. This piece will review investigations initiated under Section 232 and Section 301, and explain their significance, as well as provide analysis regarding how companies involved in international trade can stay aware of these developments and take action to adapt to them.

Section 232 National Security Investigations

Since January 20, 2025, the DOC has launched several new investigations under Section 232, broadening the focus beyond the metals, automotive, and energy sectors examined during the first Trump administration. These newer probes target industries and inputs considered vital for critical infrastructure, technological advancement, and supply chain security, reflecting the expansive interpretation of national security now prevalent in Section 232 considerations.

Overview of Initiated Investigations

The following table summarizes the Section 232 investigations initiated by the DOC since January 20, 2025, based on available information.

Table 1: Section 232 Investigations Initiated Since January 20, 2025

| Investigation Name | Initiation Date (Approx.) | Product/Sector Focus | Stated National Security Rationale |

| Copper Imports | March 10, 2025 | Copper (all forms: raw, concentrates, refined, alloys, scrap, derivatives) | Defense applications, infrastructure, emerging tech, supply chain vulnerabilities, dependence, import concentration |

| Timber and Lumber Imports | March 10, 2025 | Timber and Lumber | (Not detailed; likely construction/ infrastructure resilience, supply chain) |

| Semiconductor & Equipment Imports | April 1, 2025 | Semiconductors and Semiconductor Manufacturing Equipment | (Not detailed; likely tech leadership, critical infrastructure, defense, supply chain security) |

| Pharmaceutical & Ingredient Imports | April 1, 2025 | Pharmaceuticals, ingredients (APIs, KSMs), medical countermeasures, derivatives | Supply chain security, dependence on foreign supply, public health security |

| Critical Mineral Imports | April 16, 2025 (Directive) | Critical Minerals | (Not detailed; likely energy transition, defense tech, supply chain dependence/ concentration) |

Investigation Details

Copper Imports (Initiated March 10, 2025)

- Products/Sectors: This investigation covers a wide range of copper products, including raw mined copper, copper concentrates, refined copper, copper alloys, scrap copper, and derivative products.

- Stated National Security Concerns: The initiation order highlighted copper’s vital role in defense applications, critical infrastructure (like the electrical grid), and emerging technologies. Key concerns motivating the probe include significant vulnerabilities identified in the U.S. copper supply chain, increasing dependence on foreign sources, and the risks associated with import supply being concentrated among a small number of foreign suppliers. Global market dynamics impacting domestic industry health are also factors.

- Targeted/Implicated Countries: While the investigation is product-focused, the emphasis on import dependence and concentration inherently implicates major global copper producers and exporters.

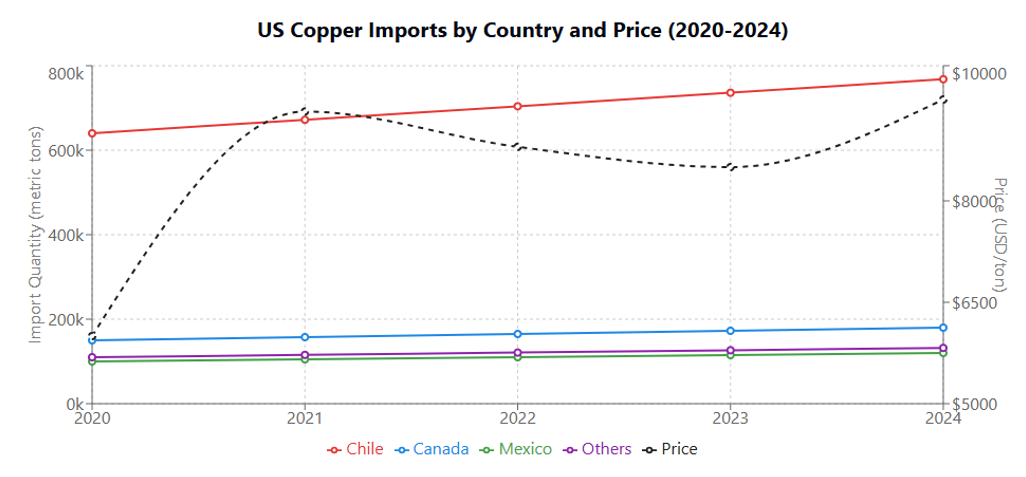

Copper Trends:

- Chile remains the dominant copper supplier to the US, providing approximately 64% of imports throughout the period 2020-4.

- All import quantities show a steady increase of about 5% annually, regardless of price fluctuations.

- Copper prices peaked in 2021 at $9,322/ton, experienced a moderate decline in 2022-2023, then recovered to $9,500/ton in 2024.

- The price volatility (55% increase from 2020 to 2021) did not significantly impact the steady growth in import volumes.

Timber and Lumber Imports (Initiated March 10, 2025)

- Products/Sectors: The investigation focuses on imports of timber and lumber.

- Stated National Security Concerns: Specific national security rationales were not detailed in the available announcement snippets. However, such an investigation likely relates to the importance of these materials for construction, critical infrastructure development and maintenance, housing availability, and the resilience of associated supply chains.

- Targeted/Implicated Countries: Major suppliers of timber and lumber to the U.S., such as Canada, would likely be significantly implicated.

Semiconductor & Equipment Imports (Initiated April 1, 2025)

- Products/Sectors: This probe examines imports of semiconductors (chips) and the specialized equipment required for their manufacture.

- Stated National Security Concerns: The formal announcement snippets lack detail on the specific rationale. However, the investigation aligns with pervasive national security concerns regarding technological leadership, securing supply chains for components essential to defense systems, communications networks, advanced computing, critical infrastructure, and economic competitiveness. There is a potential overlap here with concerns about China’s role in the semiconductor supply chain, which is also being examined under Section 301 , suggesting a multi-faceted approach to addressing challenges in this strategic sector. The government may be using Section 232 to assess broad import dependence and supply chain risks, while Section 301 targets specific unfair practices by a particular country.

- Targeted/Implicated Countries: The investigation would necessarily involve major semiconductor manufacturing centers, primarily in Asia (e.g., Taiwan, South Korea, China), as well as global suppliers of semiconductor manufacturing equipment.

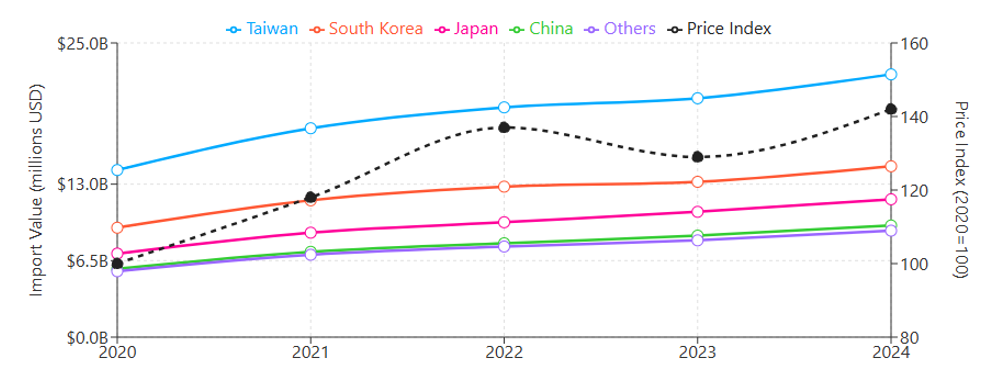

U.S. Semiconductor & Equipment Imports by Country (2020-2024)

Semiconductor Trends:

- Taiwan consistently leads as the dominant supplier of semiconductors and equipment to the US, representing approximately 33-34% of total imports throughout the period.

- Overall semiconductor imports have grown substantially, increasing by nearly 60% from $42 billion in 2020 to $67.1 billion in 2024.

• The semiconductor price index rose sharply between 2020-2022 (+37%), showing the impact of global chip shortages during this period. - Despite a brief price correction in 2023, the price index resumed its upward trend in 2024, reaching 142 (2020=100).

- All major supplying countries maintained their relative market share positions throughout the period, suggesting stable trade relationships despite global supply chain challenges.

- The data shows that semiconductor imports continued to grow even during periods of price increases, indicating the critical nature of these components for US manufacturing and technology sectors.

Pharmaceutical & Ingredient Imports (Initiated April 1, 2025)

- Products/Sectors: The scope is comprehensive, covering finished pharmaceutical products (both generic and branded), medical countermeasures (like vaccines or treatments for specific threats), and critical inputs such as Active Pharmaceutical Ingredients (APIs) and Key Starting Materials (KSMs), along with their derivatives.

- Stated National Security Concerns: The investigation seeks to determine the effects on national security stemming from reliance on foreign supply chains for essential medicines and their constituent components. It examines the extent to which domestic production can meet U.S. demand and assesses vulnerabilities related to foreign supply, framing public health security and access to critical medicines as a national security imperative.

- Targeted/Implicated Countries: The focus on foreign dependence points towards major global suppliers of APIs and finished drug products, particularly China and India, which play significant roles in the global pharmaceutical supply chain.

Critical Mineral Imports (Directive to Initiate April 16, 2025)

- Products/Sectors: The investigation targets “Critical Minerals”. While a specific list was not provided in the snippets, this category generally includes minerals deemed essential for strategic sectors like defense, renewable energy technologies (batteries, solar panels, wind turbines), advanced electronics, and aerospace, and which are subject to potential supply disruptions. This follows previous Section 232 probes into related materials like Uranium and Neodymium-Iron-Boron magnets.

- Stated National Security Concerns: The rationale was not detailed in the directive snippet. However, it aligns with widespread international concerns about the concentration of mining and processing for many critical minerals in a limited number of countries, particularly China. Ensuring reliable access to these materials is viewed as vital for national defense, economic competitiveness in high-tech industries, and the clean energy transition.

- Targeted/Implicated Countries: The investigation would likely focus heavily on countries that dominate the global supply chains for specific critical minerals, both in extraction and processing, with China being a primary focus due to its significant market share in many of these areas.

Analysis of Section 232 Investigations

The selection of these sectors – copper, timber, semiconductors, pharmaceuticals/APIs, and critical minerals – signals a strategic focus under Section 232 on foundational inputs and technologies. These materials and components are essential building blocks across a wide array of downstream industries, critical infrastructure, and defense applications. This focus reflects the broader interpretation of national security to include economic security, technological leadership, and overall supply chain resilience for the U.S. economy, potentially representing a deeper level of intervention into industrial supply chains compared to earlier Section 232 actions focused on primary metals like steel and aluminum.

Section 301 Unfair Trade Practice Investigations (Since Jan 20, 2025)

Activity under Section 301 since January 20, 2025, has maintained a significant focus on the trade practices of China, launching new actions targeting specific sectors where state intervention is alleged to distort markets and harm U.S. interests. This includes concluding investigations initiated prior to this period and potentially initiating new ones.

Overview of Initiated Investigations/Actions

The following table summarizes key Section 301 investigations or actions involving USTR since January 20, 2025.

Table 2: Section 301 Investigations/Actions Since January 20, 2025

| Investigation/ Action Name | Date(s) | Target Country | Foreign Practice/ Sector Focus | Status/ Proposed Remedy |

| China: Maritime, Logistics, Shipbuilding | Petition March 2024; Proposed Action February 21, 2025; Final Action Apr 17, 2025 | China | State targeting for dominance, non-market policies, subsidies, displacing foreign firms | Action Taken: Phased-in fees on vessel calls (tonnage/ container based); future restrictions on LNG transport via foreign vessels |

| China: Legacy Semiconductors | Investigation Initiated Jan 2025 | China | Non-market practices, state support, impact on critical downstream industries, supply chain | Investigation Ongoing; Potential Remedies: Tariffs on chips; potential “component tariffs” on downstream products |

| China: Tech Transfer, IP, Innovation (Ongoing Review) | Statutory Review ongoing; Tariff modifications announced February 2025 | China | Forced tech transfer, IP theft, cyber theft, discriminatory licensing, state investment | Existing tariffs maintained/ modified; rates increased on semis, critical minerals, solar; potential new tariffs floated |

Investigation Details

China: Maritime, Logistics, and Shipbuilding Sectors (Action Announced April 2025)

- Foreign Practices: Following a petition filed by five U.S. national labor unions in March 2024, USTR investigated China’s alleged “unreasonable” acts, policies, and practices aimed at dominating the maritime, logistics, and shipbuilding sectors. These practices included non-market policies, extensive state support and subsidies, and explicit market share targets designed to displace foreign competitors.

- Affected U.S. Commerce/Sectors: USTR concluded that China’s targeting strategy burdens or restricts U.S. commerce by undercutting business opportunities and investment for U.S. firms in these sectors, reducing competition and choice, creating dependencies on China, and increasing supply chain risks and vulnerabilities. The action aims partly to support the U.S. commercial shipbuilding industry.

- Targeted Country: China.

- Status/Outcome: USTR determined China’s practices were actionable under Section 301(b). On April 17, 2025, USTR announced responsive actions, implemented in phases. Phase 1 includes fees imposed on vessel owners/operators based on net tonnage per U.S. voyage for China-flagged ships, fees on operators of Chinese-built ships (based on tonnage or containers), and fees on foreign-built car carriers to incentivize U.S.-built alternatives. Phase 2 actions, deferred for three years, involve restrictions on transporting Liquefied Natural Gas (LNG) via foreign vessels, increasing incrementally over 22 years.

China: Legacy Semiconductors1 (Initiated January 2025)

- Foreign Practices: USTR initiated an investigation into China’s alleged non-market practices, including government subsidies and other forms of state support, related to the manufacturing of foundational or “legacy” semiconductors (older generation chips). The probe examines the production of these chips, the wafers used to make them, and their integration into downstream products across critical industries.

- Affected U.S. Commerce/Sectors: The investigation focuses on how China’s practices burden U.S. commerce, potentially through market distortions that harm U.S. producers or by creating dependencies and supply chain risks in critical sectors that rely heavily on these ubiquitous chips, such as defense, automotive, medical devices, telecommunications, and power infrastructure.

- Targeted Country: China.

- Status/Outcome: The investigation is ongoing as of the latest available information. Potential remedies, should USTR make an affirmative finding, could include tariffs imposed directly on imports of legacy semiconductors from China. Significantly, USTR may also consider “component tariffs”—duties levied on finished downstream products imported from any country if those products are found to contain China-origin legacy chips. This novel approach could dramatically expand the scope and complexity of the remedy.

China: Technology Transfer, IP, and Innovation (Ongoing Review/Tariff Modifications)

- Foreign Practices: This relates to the continuation and statutory review of the Section 301 action initiated during the first Trump administration targeting China’s practices related to technology transfer, intellectual property (IP), and innovation. USTR’s review, mandated by statute, examined whether China had eliminated the problematic acts, policies, and practices, which included requirements for U.S. companies to transfer technology, discriminatory licensing terms, state-supported investment aimed at acquiring U.S. technology, and state-sponsored cyber intrusions to steal IP and trade secrets. The review concluded that China persisted in these practices and may have even expanded cyber theft activities.

- Affected U.S. Commerce/Sectors: The practices continue to burden U.S. commerce across numerous technology-intensive sectors by undermining IP rights, creating unfair competitive advantages for Chinese firms, and restricting market access.

- Targeted Country: China.

- Status/Outcome: Following the review, the Biden-Harris administration largely maintained the existing Section 301 tariffs on lists of Chinese goods, which range from 7.5% to 25%. However, modifications were announced or proposed. February 2025 updates indicated significant tariff rate increases on certain strategic goods effective in 2025, including semiconductors (to 50%), certain critical minerals (to 25%), and solar components (to 50%). Additional tariffs were also potentially planned for other goods like coal, crude oil, LNG, agricultural machinery, and large-engine vehicles. Furthermore, President Trump, prior to the hypothetical start of the second term, had floated proposals for much broader tariff increases on Chinese goods (e.g., an additional 10% across the board, or rates exceeding 60%). The product exclusion process, allowing importers to request temporary relief from the tariffs for specific items, remains a feature of this action.

Analysis of Section 301 Investigations

The drivers for initiating Section 301 actions vary. Some arise directly from petitions submitted by affected domestic stakeholders, such as the labor unions in the shipbuilding case. Others are self-initiated by USTR, reflecting broader strategic objectives identified by the administration, as was the case with the original China IP investigation and likely the legacy semiconductor probe. This flexibility allows the tool to be responsive both to specific industry grievances and overarching policy goals.

However, the potential use of novel and complex remedies, such as the service fees implemented in the shipbuilding case and particularly the contemplated component tariffs in the semiconductor investigation, poses significant challenges for international businesses. Component tariffs, especially, would impose substantial compliance burdens, requiring importers of finished goods from potentially any country to trace the origin of embedded components – a task many firms currently find difficult or impossible. This represents a potential escalation in the practical complexity and administrative difficulty of Section 301 enforcement.

Key Trends

- Sustained Unilateralism: There is a clear continuity in the willingness to employ unilateral trade measures under domestic law, sometimes bypassing or acting parallel to multilateral frameworks like the WTO.

- Expansive National Security Definition: Section 232 is increasingly utilized to address economic vulnerabilities and supply chain risks in sectors deemed critical, moving beyond traditional defense procurement needs.

- Systemic Focus on China: Section 301 actions concentrate heavily on challenging China’s state-directed economic model, industrial policies, and alleged non-market practices across various strategic sectors.

- Remedy Innovation and Complexity: There is an exploration of remedies beyond traditional tariffs, including fees on services and potentially complex component-level tariffs, which could significantly increase compliance burdens and broaden the impact of trade actions.

For additional historical and theoretical context explaining these key trends, see the linked article written by one of our team members.

1“Legacy Semiconductors” refer to older generations of semiconductor chips, typically manufactured using processes at 28 nanometers (nm) and above, in contrast to the cutting-edge 5nm or 3nm (“advanced node”) technologies prominent today.

/>i

/>i